HSBC Zhi Yin

Back to Business Banking with HSBC

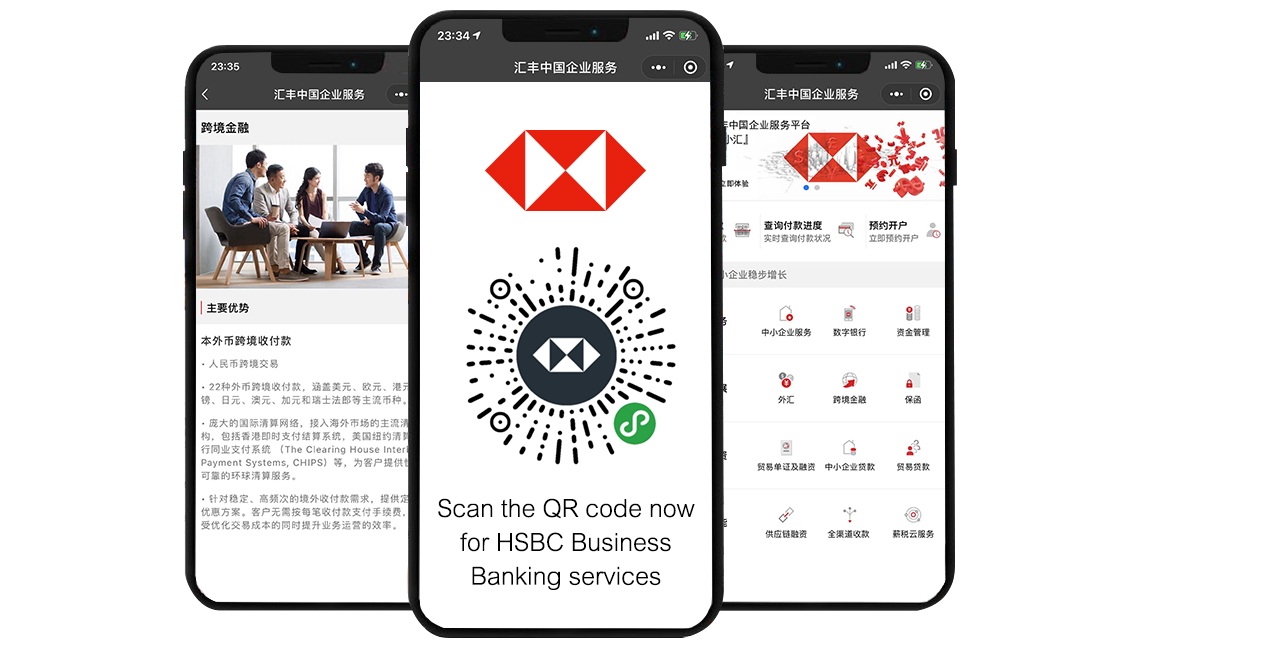

HSBC China Corporate Banking WeChat Mini Program

One interface that covers a full range of SME banking solutions. It is designed to empower clients for efficient development by providing up-to-date information on treasury management for SMEs as well as plain vanilla features such as account inquiry

- Linked to your accounts at HSBC China and HSBC Hong Kong. Account details viewable in real time.

- One-button access to HSBC Easy-Payroll.

- AI-powered live chat available 7x24, providing on-demand banking advice in a timely manner.

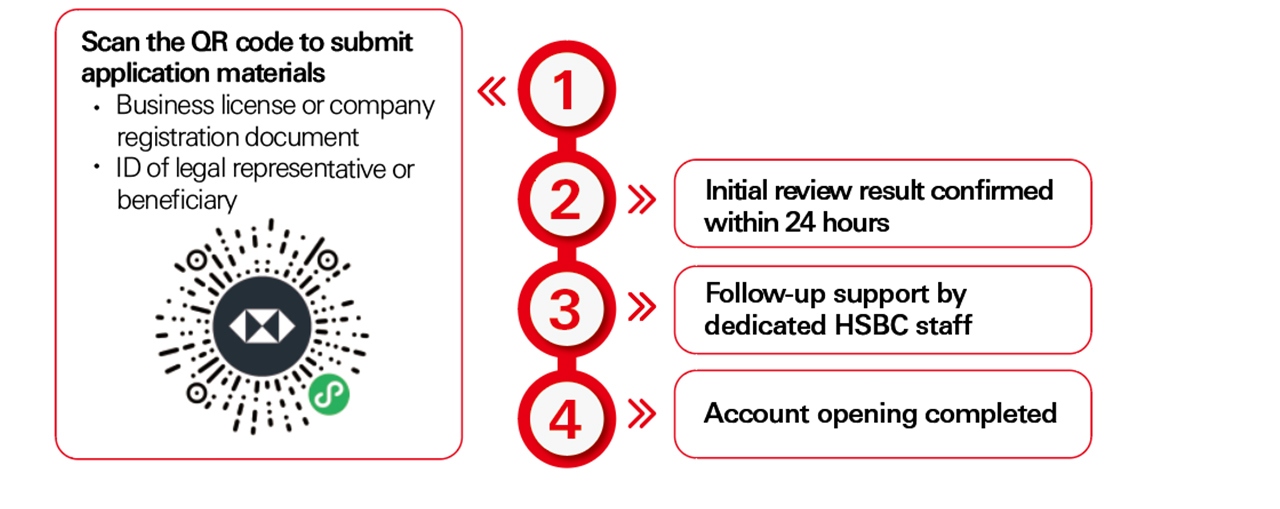

Digital application for account opening

Fully digitalised process that delivers a faster, easier and more transparent account opening experience for SME clients.

- One-button access to application and material submission

- Confirmation by HSBC within 24 hours

- Streamlined list of required documents and information items

- Access to HSBC’s digital banking platform via PC, mobile APP and HSBC China Corporate Banking WeChat Service Account activated immediately after account opening

SMEs are one of the main drivers of the Chinese economy. HSBC has been closely following the development of SMEs in China and created a wide array of forward-looking financial solutions to meet their needs. The Bank is committed to providing solid financial support for SME clients to seize emerging business opportunities for renewed growth.

Industry-leading digital banking platform

- Streamlined and easy-to-use e-banking system for SMEs

- Paperless multi-currency e-payment system that supports real-time status tracking

- Comprehensive e-FX trading platform for different needs

- Mobile solution for omni-channel collections

- ERP Adaptor – plug-and-play cash management H2H solution

- Guangdong-Hong Kong Express Payment, as fast as 2 minutes

Crossover collaboration

-

E-Payroll is a one-stop digital solution for payroll management, in collaboration with eRoad. Besides basic payroll services, the solution also features value-added offerings including HR support, compensation calculation, tax calculation and tax management.

Learn more

-

E-Reimbursement is a one-stop digital solution for reimbursement and expense control, in collaboration with ekuaibao, a leading reimbursement/expense control service provider. The solution provides clients with a digital platform for mobile-enabled reimbursement, centralised spending management, expense control, budget management and invoice management.

Learn more

Diverse lending and financing

- Diverse lending options with flexible tenors and methods of payment to provide liquidity support for corporates

- Innovative products including Property Backed Loan Express, SME Finance Guarantee Scheme, Vzoom Tax Loan, with credit limit up to RMB 10 million, available in Beijing, Shanghai, Guangzhou and Shenzhen

- Cross-border (e-commerce) financing solutions featuring offshore debt under onshore guarantee and onshore debt under offshore guarantee to address onshore-offshore funding gap for our corporate clients

- Trade finance solutions for international and domestic trade

Request a call back

Find out more

Dedicated Service

We are committed to fulfilling customer needs across all stages of their development through dedicated financial services and support.

Digital Banking

HSBC’s innovative digital banking is designed to empower SMEs with fintech to surge on as a renewed source of economic prosperity.

Product and Solution

Business banking with HSBC

HSBC Pioneer

HSBC Pioneer is our exclusive programme of next-level banking services and solutions, designed to accelerate fast-growing businesses by providing for their needs of tomorrow.