E-Tax Service Now Available across All Branches of HSBC China

Back to Bridging the GBA, Spanning the GlobeOn 14 October 2019, HSBC China E-Tax service was officially launched in Shenzhen upon regulatory approval. Soon after, on 25 October 2019, it went live in Guangzhou. So far, the service has expanded to 45 cities in Mainland China and is now available across all cities where HSBC China’s branches are located.

Features of HSBC E-Tax

- Fast signing of agreement: express online agreement signing enabled by e-signing function

- Flexible payment options: multiple payment options available, including automatic payment and bank-based payment

- Flexible payment sources: tax payable from a non-local HSBC account or by HSBC client for its subsidiaries

(Note: payment source subject to approval by tax authorities)

Major tax types covered by HSBC E-Tax

- VAT

- Corporate Income Tax

- Individual Income Tax

- Urban Maintenance and Construction Tax

- Education Surtax

- Stamp Tax

(Note: subject to information provided by tax authorities)

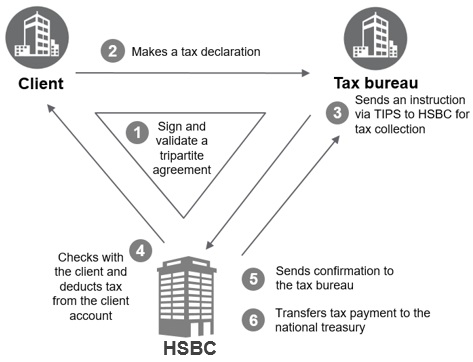

Service process of HSBC E-Tax

Case Study

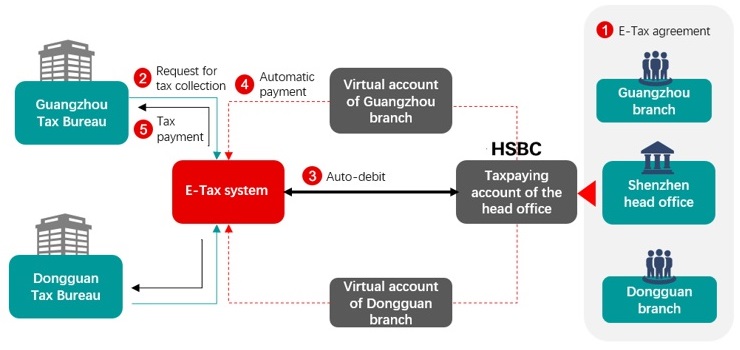

ABC is a Shenzhen-based company with subsidiaries in Guangzhou and Dongguan. The company’s head office and its subsidiaries used to pay taxes from their respective accounts to their local tax authorities, thus causing considerable inconveniences and unnecessary delays to the company’s financial management. The head office had always wanted to be able to allocate and utilize its liquidity with a centralized system in order to make more efficient use of its capital. However, with the company growing in size, its subsidiaries gradually came along and became profitable. As a result, tax management emerged as a real headache for the company’s finance department at the head office. Recently, through its daily communication with HSBC, the company learned about the bank’s E-Tax solution (details provided below), which turns out to be a perfect fit for the company’s geographic coverage and financial needs. Since its adoption of E-Tax across its nationwide subsidiary network, financial management has become easier for the company’s head office while its accounts have become more structured.

E-Tax

In October 2013, HSBC China started to offer E-Tax service to its corporate clients. The service, based on TIPS ( Treasury Information Processing System, which covers the PBOC, tax bureaus and commercial banks ), is designed to enable automatic transmission of electronic tax payment messages and instructions that drives higher efficiency across multiple steps including tax payment, fund transfer and payment to the treasury and thus makes tax payment much easier for its clients.

As of now, HSBC China has launched E-Tax in 45 cities, namely Shanghai, Beijing, Xiamen, Taiyuan, Xi’an, Wuhan, Chengdu, Wuxi, Chongqing, Dalian, Kunming, Nantong, Tangshan, Harbin, Changsha, Tianjin, Yangzhou, Nanchang, Hefei, Changchun, Nanjing, Shenyang, Zhuhai, Zhengzhou, Ningbo, Fuzhou, Jinan, Hanzghou, Qingdao, Shaoguan, Zhaoqing, Jiangmen, Huizhou, Shantou, Nanning, Chaozhou, Yangjiang, Foshan, Suzhou, Zhanjiang, Dongguan, Zhongshan, Shenzhen and , Guangzhou and Shijiazhuang.

HSBC China will continue to provide its corporate clients with comprehensive and robust cash management services.

Important notice: This document is issued by HSBC (as defined below) and is for the exclusive use of the person to whom it is provided. It is not intended for onward distribution. It is intended for general information only. This document does not constitute an offer or advice for you to purchase from or otherwise enter into any transaction with HSBC or any member of the HSBC Group (as defined below). It is not for solicitation of business across international borders where to do so may require licensing and/or consent from the applicable regulatory authority. Products/services described in this document may not be available in all jurisdictions. HSBC makes no guarantee, representation or warranty (express or implied) and accepts no responsibility or liability for the contents of this document and/or as to its currency, accuracy or completeness and expressly disclaims any liability whatsoever for any losses (including but not limited to any direct, indirect or consequential losses) arising from or in connection with, including any reliance upon, the whole or any part of the contents of this document by any person and such liability is excluded to the maximum extent permitted by law. You are responsible for making your own evaluation about the products referred to in this document. Nothing in this document is intended by HSBC to be construed as financial, legal, accounting, tax and/or other advice. HSBC recommends that before you make any decision or take any action that might affect you or your business, you consult with suitably qualified professional advisers to obtain the appropriate financial, legal, accounting, tax and/or other advice. © Copyright HSBC [2022]. All rights reserved. For the purposes of the foregoing: “HSBC” means one or more members of the HSBC Group which issue(s) this document. “HSBC Group” means HSBC Holdings plc and its subsidiaries and affiliates from time to time