Digital Banking

Back to Digital Banking

Seamless Connection

ERP adaptor, a cash management corporate and bank integration solution

It can help corporate customers to connect their ERP system to HSBC platform in an automated, seamless and fast manner.

E-bank acceptance draft, bespoke solutions for trade finance

It offers a more convenient and flexible approach to draft issuance, endorsement, collection, discounting, etc. It delivers higher efficiency in AR/AP settlement and capital turnover together with additional benefits including reduced payment risks, more efficient financial operations and cost savings for corporate customers.

Track trade transactions and payment status anytime, anywhere

- It covers 3 channels including WeChat, online banking mobile APP and emails. Can meet customer needs to access trade transactions at anytime, anywhere.

- Get an overview of your trade and guarantee transactions

- View real time status of export and import documentary credits, collections, trade loans and guarantee transactions

- Real time courier tracking of export documents

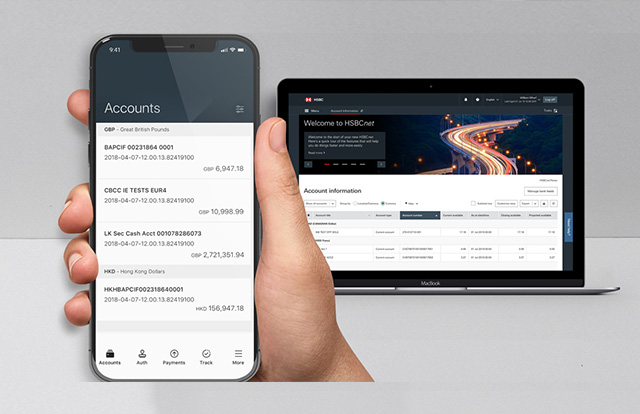

Track payments

It gives you increased visibility and makes it easier to manage and track your payments via both laptop and mobile. You can filter and manage payments using multiple criteria, such as currency, destination country, amount, plus many others.

New interface of HSBCnet view all your HSBC accounts in one place

- A simple and intuitive homepage: A new ‘Task’ panel with shortcuts to your most used screens, like payments pending authorisation , recently used tools and Virtual Assistant

- All your HSBC accounts in one place: View up-to-date balances on the homepage the minute you log in, or drill down to individual accounts for fast access to specific details and tools

- Payments that are easier to create: Fewer screens means simpler and faster payment creation, and real-time input validation means you can correct errors before submitting a payment

- A snapshot of all your authorisations: A redesigned summary page shows the progress of your current authorisations. Plus, direct links to useful tools help you make sure your payments reach the beneficiary bank

Biometric capabilities available on mobile

HSBCnet Mobile now supports a full suite of biometric capabilities, including Touch & Face ID for iOS devices, as well as Fingerprint ID for supported Android devices. These provide a fast, simple and secure way to view your HSBC accounts and balances on the go. Once enabled, simply use your fingerprint or facial recognition to log in – making it even quicker to access your HSBCnet services anytime, anywhere.

Virtual assistant with 7 X 24 support

Round the clock, wherever you are, HSBCnet keeps you fully supported with a range of innovative online help and assistance options that are designed to make your life simpler and resolve problems faster. Chat with us online if you have a query, ask your own questions, explore features and browse frequently asked questions. Additionally, NetPlus provides training materials and videos to help you get the best out of HSBCnet.

In addition, AI based chat-bot Xiao Hui provide 7X24 seamless smart interaction, voice and text recognition, powered up by AI intelligent, semantic analysis and profound RMs’ knowledge and keep learning by experience.