The booming of innovation and businesses in rural areas in recent years has driven many young people to devote themselves in the revitalisation and economic development of their hometowns.

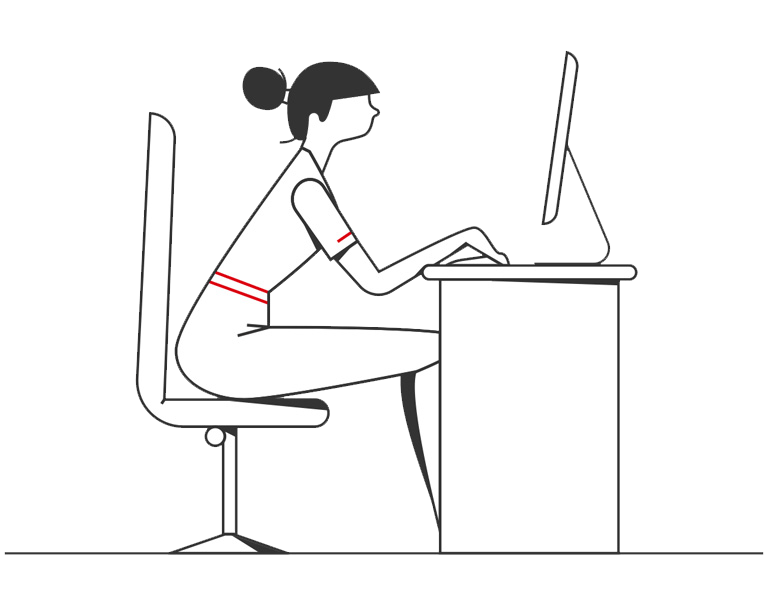

Young entrepreneur in Tianmen, Hubei founded Hornet Plant Protection Service Cooperative to promote the new technology of using drones to spray pesticides. The new technology can effectively save water, reduce the use of pesticide, as well as avoid the risk of operator getting pesticides-poisoned from spraying manually.

The Cooperative also organised training sessions for trainees to learn how to spray pesticide using drones, allowing small famers to find a new source of income.

The Cooperative was supported by HSBC-Haihui programme with RMB 30,000. Since 2018, HSBC have been supporting Haihui’s poverty-alleviation entrepreneurship programme in Tianmen, Hubei. From entrepreneurship training to seed fund, the programme adhered to the Chinese proverb: “Give a man a fish, you feed him for a day; teach a man to fish, and you feed him for a lifetime”. This promotes the sustainable development of rural entrepreneurship.

People who returned hometown to run new business can receive support from both charitable programs and HSBC’s inclusive finance services.

Not only could the entrepreneurs acquire “the first bucket of gold” from HSBC Rural Bank, but they could also receive immediate support from HSBC. Due to the heavy rain and flooding in 2016, a customer on grain procurement and sales businesses faced cash flow problems. HSBC provided a loan of RMB 300,000 to help sustain the business.

In the past ten years or so, HSBC has continued to root in county-level areas and service the rural financial market, to empower the rural development. By far, HSBC has the largest rural bank network among foreign banks in China. HSBC implemented flexible credit loan policies according to the features in the capital demand of “Agriculture, Farmers and Rural Areas” as well as small and micro-enterprises, in an attempt to actively pave the way for the “last kilometre” in financial services. By 2019, the cumulative loans of HSBC Rural Bank in China amounted to nearly RMB 25.8 billion.

As early as in 2004, HSBC has begun to focus on the countryside and make charitable donations for targeted poverty-alleviation, with a total donation of over RMB 91 million. More than 10,000 farmers from more than 6,000 farming households have benefited from increased income. More than 1,000 rural teachers were trained to improve rural education quality. Over 100,000 rural migrant workers were helped to upgrade their vocational skills. More than 30,000 rural children have been helped to improve their emotional connection with parents. More than 600,000 people times of financial capability courses have been provided rural pupils.

HSBC hopes that more people who are passionate about this cause can join us to unlock the future potential of rural areas, and to pursue a well-off life.